By UNCTAD Economists

© Confidence

In many parts of the world, women have had less access to financial services than men for years. The COVID-19 pandemic has exacerbated the challenge.

At the onset of the pandemic, more women than men lost jobs. Sectors that absorb women workers such as tourism and personal services were hardest hit.

In 2019, women accounted for 53% of jobs in accommodation and food service activities. By 2020, international travel receipts, excluding passenger transport, had declined by 63% from the previous year, dealing a heavy blow to these sectors. Income losses suffered by women migrant workers in the services sectors were particularly severe.

According to the World Bank, remittance flows to developing countries in 2021 are projected to decline by roughly $78 billion, relative to 2019. This amounts to a projected drop of above 7% for both 2020 and 2021.

Losses in remittances have an indirect impact on women’s economic empowerment in their countries of origin. Remittances are often used for food, health and other social services for the benefit of a family.

Generally, women manage such funds. Women also bear the brunt of a fall in disposable income for necessary household goods and services.

Persistent gender gap

Even before the pandemic, women had less access to financial services than men in many parts of the world. In 2017, 65% of women had a financial account compared with 72% of men.

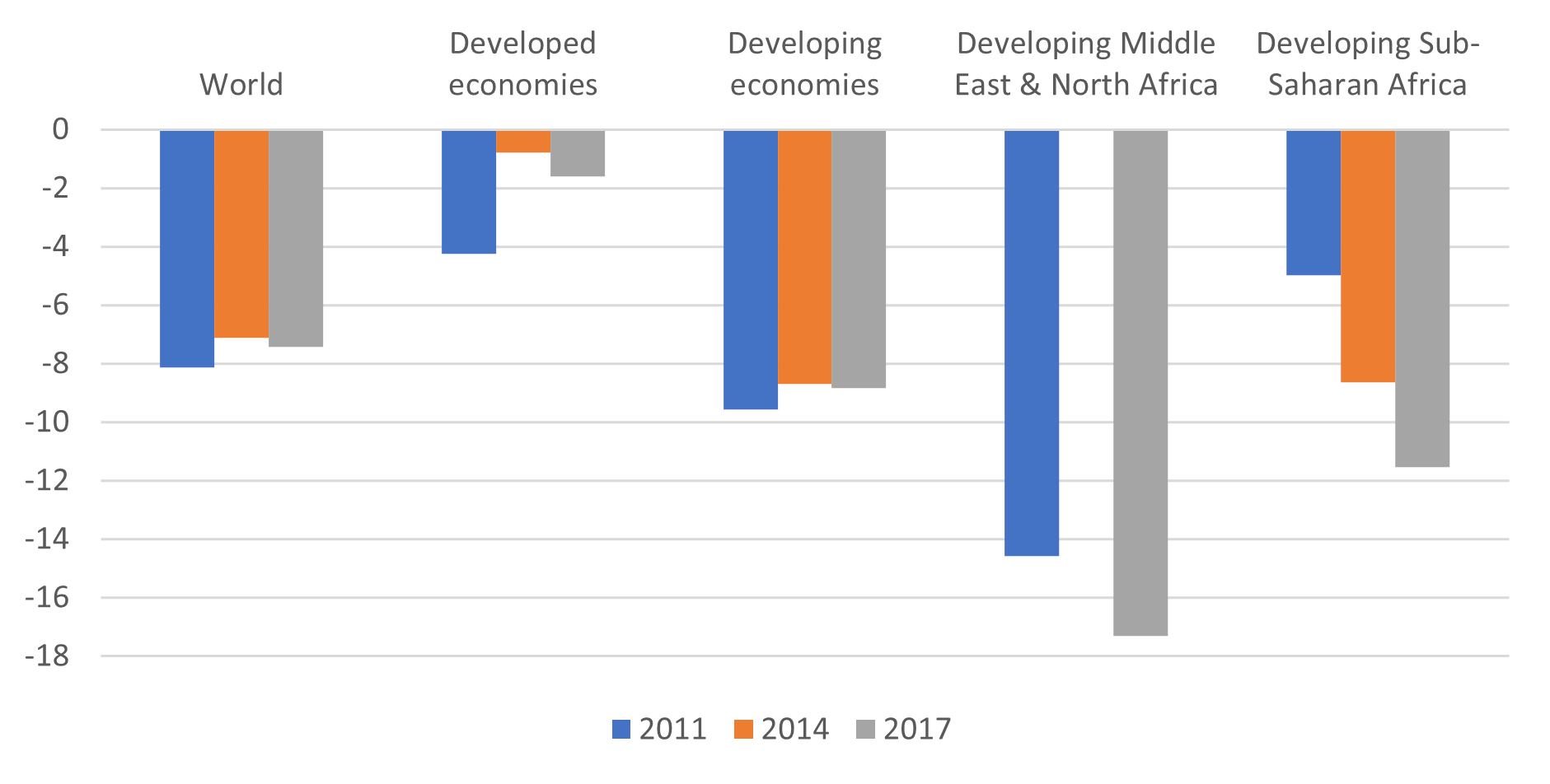

While the gender gap at the global level diminished between 2011 and 2017, some developing regions, including Middle East and North Africa and Sub-Saharan Africa, witnessed a reverse trend (Figure 1).

Figure 1: Gender gap in financial account penetration 2011, 2014 and 2017 (Percentage)

Note: Mobile money services included. Negative values indicate that the share of women is lower than that of men.

What accounts for the gender gap in access to and use of financial services? The gap often reflects societal constraints, resulting from domestic laws and regulations that exclude women from financial services.

For example, in some parts of the world, women are not allowed to become legal owners of productive resources such as land or properties.

Most banks require collateral to lend and demand that assets be registered in the borrower’s name. In some instances, women cannot have bank accounts or businesses in their own name without the husband’s permission.

The way financial services are set up can pose other impediments. For example, minimum balance requirements for opening an account can work against women whose business revenues are small and irregular.

Also, documentation requirements can penalize women, particularly in rural areas and the informal sector, if they lack official payslips or proof of residence.

Physical access to credit providers poses another challenge, as women face constraints in travelling time or distance. Financial institutions often don’t open offices in rural areas.

How to bridge the gap

Reducing the gender gap in financial inclusion would require applying a gender lens to domestic and international policy actions. The barriers impeding women’s access to financial services are multi-dimensional.

The approach needs to be coherent with measures applied to redress the structural impediments to the socioeconomic empowerment of women. Such a coherent approach would include the following actions at the national level, and for which more international cooperation is needed:

- Collect better data on women’s access to and use of financial services: The design and implementation of the policy mix for better access of women to financial services would benefit greatly from the availability of disaggregated data on women’s particular situation. Such data should include not only the account penetration rate but also the progress on women’s economic empowerment, to help assess the impact of financial exclusion facing women.

- Apply a gender lens to existing policy measures: Recent years have seen innovative efforts by state-owned, cooperative, development and community banks to extend access to finance to women and other underserved people. Expanding networks of agents in financial services, such as post offices and retail outlets, can also reduce the gender gap in financial inclusion.

- Promote digital financial inclusion: Digital and mobile financial services can include savings, insurance and information-based services, such as data tracking financial services usage to facilitate credit risk assessment. Remittances’ transfer also benefits from digital solutions that reduce costs. These innovations promise to address some of the challenges faced by women. However, the gender digital divide, including digital literacy, which persists in many parts of the world, especially in developing countries, must be bridged.

- Address demand-side constraints: Policy measures to redress demand-side constraints would also be helpful. Actions can include education or training to improve women’s financial literacy and inform them on consumer protection in financial services, as outlined in the UN guidelines for consumer protection. Initiatives to improve women’s physical access to financial institutions, for instance providing desks reserved for women, is one of the policy measures that can be implemented immediately.

UNCTAD’s sixth Trade Policy Dialogue to be held on 28 April will provide a forum to exchange recent experiences and views on applying a gender lens to financial inclusion.

It will focus on innovative policies, initiatives and measures that identify further needs, gaps and bottlenecks and implications for future action. The event builds on UNCTAD’s recent study on financial inclusion for development.

UNCTAD economists Miho Shirotori, Dong Wu, Bruno Antunes and Vincent Valentine contributed to this commentary.