Between the start of the COVID-19 pandemic and mid-2021, commodity prices increased across the region, with varied impacts on countries.

Miners in Potosi, Bolivia. © saiko3p

Commodity prices across the board have increased significantly in recent months in the Latin America and the Caribbean (LAC) region.

As countries in the region strive to rebuild their economies after the COVID-19 pandemic, a new UNCTAD study reviews and analyses the factors behind the price increases and their potential impact on commodity-dependent developing countries (CDDCs) in LAC.

“This is an important development since commodity sectors play a vital role for many economies in the region,” the study says.

The report underlines that structural differences across the region will likely result in heterogenous impacts of commodity price increases on trade and GDP growth in the CDDCs.

Most importantly, the high level of uncertainty on commodity markets and the high degrees of commodity dependence across the region underscore the need to boost the resilience of LAC economies to future shocks, in particular for CDDCs.

Drivers of commodity price hikes

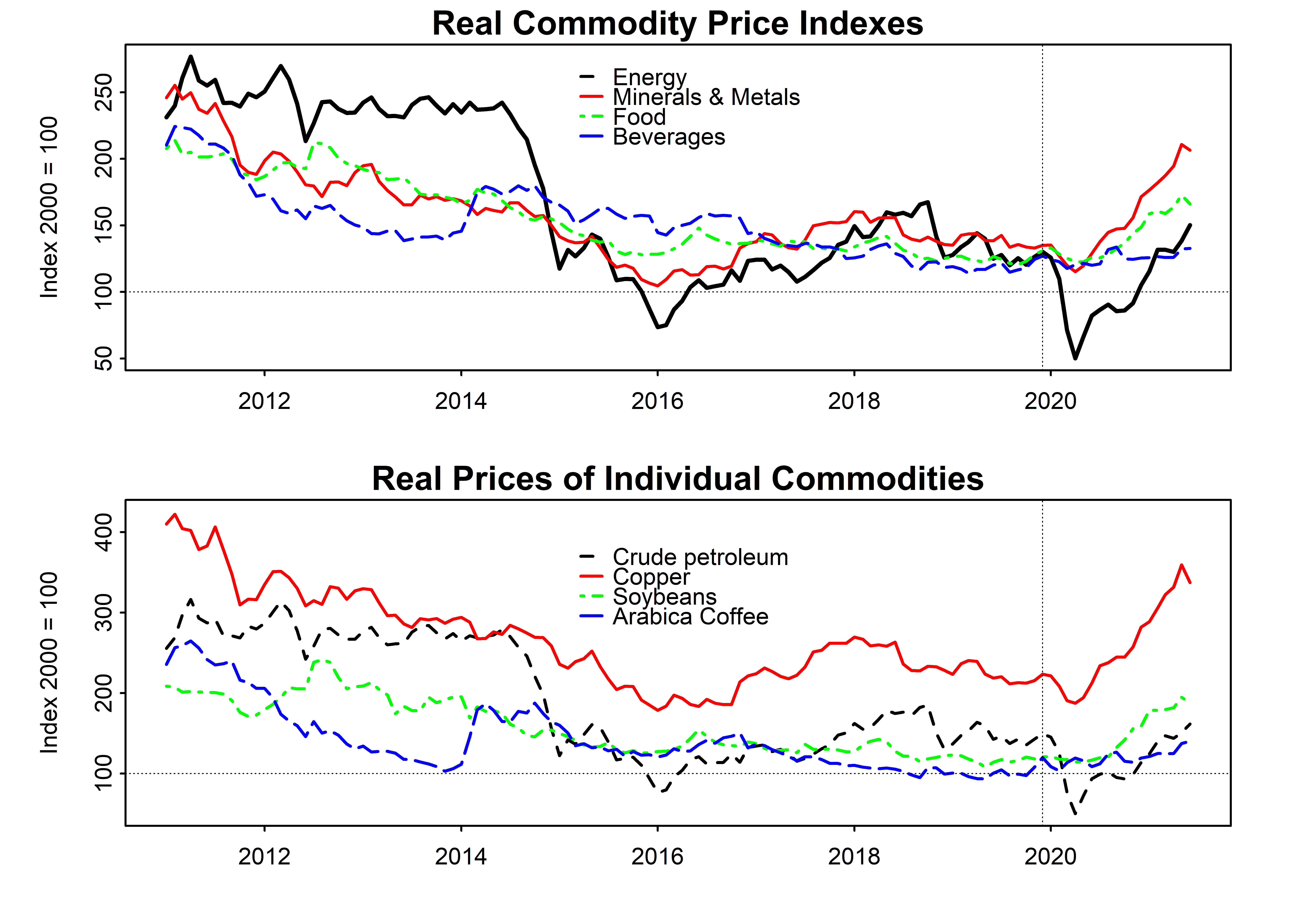

The study highlights two key drivers of the recent commodity price hikes. The first one is the recovery in world economic activity as countries advanced in their vaccination efforts and subsequently removed movement restrictions.

Secondly, the improvement in investor and consumer expectations also contributed to commodity price increases, especially for energy and mineral and metal commodities.

For the latter group of commodities in particular, the study says, factors associated with the global energy transition might also be contributing to the evolution of prices over the longer term.

Source: Authors’ calculations using World Bank and United States Bureau of Labor Statistics data.

Impacts of the price increases are varied

The study says the impacts of commodity price increases in the region are compounded by differences in public indebtedness, domestic policy environments and other socio-political-economic factors impacting on macroeconomic variables.

According to UNCTAD, 14 out of 33 countries in the LAC region are commodity dependent, meaning commodities account for 60% or more of their total merchandise export revenue.

Another seven countries in the region have a commodity share of 50% to 60%, hence commodity sectors play a major role in their economies.

“For many commodity exporters in LAC, price increases have led to increases in commodity export revenues in spite of stagnant or falling export volumes,” the study says.

For instance, Brazil's export revenue from oilseeds in the first six months of 2021 was 24.3% higher than in the same period of 2020 although exported volumes were slightly lower.

On the other hand, commodity price increases have a negative effect on the trade balances of commodity importers, the study shows.

For countries that import substantial amounts of basic commodities such as food and fuels, high commodity prices mean higher import bills and could cause a rise in poverty and food insecurity.

For example, Costa Rica's cereal import bill during the first five months of 2021 was 34.8% higher than during the same period of 2020, while import volumes only increased by 5%.

Time to strengthen domestic institutions and policy frameworks

According to the study, now is the time to strengthen domestic institutions and policy frameworks to increase the resilience of LAC economies to the impacts of future external shocks, such as commodity price fluctuations and capital flow volatility.

The study’s findings will feed into discussions at the Global Commodities Forum scheduled for 13 to 15 September.

The precursor to UNCTAD’s 15th quadrennial conference slated for 3 to 7 October will help frame international policy discussions on commodities, especially on challenges and opportunities for developing countries and particularly commodity-dependent ones.

It will feature four thematic sessions and a high-level roundtable bringing together experts, policymakers and high-level political and institutional representatives from all regions of the world.