The pandemic has accelerated the shift towards a more digital world and triggered changes in online shopping behaviours that are likely to have lasting effects

© Adobe Stock Images

The COVID-19 pandemic has forever changed online shopping behaviours, according to a survey of about 3,700 consumers in nine emerging and developed economies.

The survey, entitled “COVID-19 and E-commerce”, examined how the pandemic has changed the way consumers use e-commerce and digital solutions. It covered Brazil, China, Germany, Italy, the Republic of Korea, Russian Federation, South Africa, Switzerland and Turkey.

Following the pandemic, more than half of the survey’s respondents now shop online more frequently and rely on the internet more for news, health-related information and digital entertainment.

Consumers in emerging economies have made the greatest shift to online shopping, the survey shows.

“The COVID-19 pandemic has accelerated the shift towards a more digital world. The changes we make now will have lasting effects as the world economy begins to recover,” said UNCTAD Secretary-General Mukhisa Kituyi.

He said the acceleration of online shopping globally underscores the urgency of ensuring all countries can seize the opportunities offered by digitalization as the world moves from pandemic response to recovery.

Online purchases rise but consumer spending falls

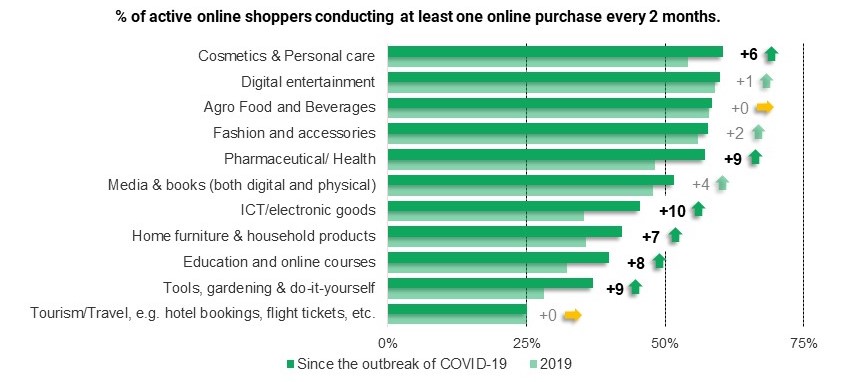

The survey conducted by UNCTAD and Netcomm Suisse eCommerce Association, in collaboration with the Brazilian Network Information Center (NIC.br) and Inveon, shows that online purchases have increased by 6 to 10 percentage points across most product categories.

The biggest gainers are ICT/electronics, gardening/do-it-yourself, pharmaceuticals, education, furniture/household products and cosmetics/personal care categories (Figure 1).

Figure 1: Percentage of online shoppers making at least one online purchase every two months

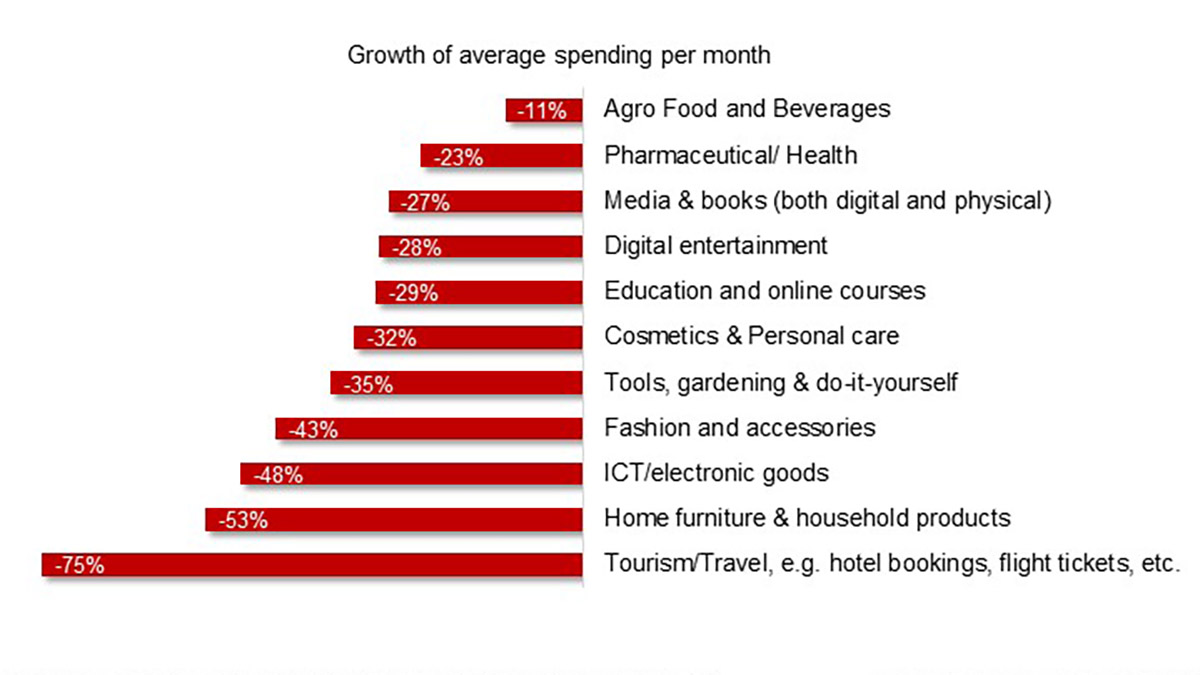

However, average online monthly spending per shopper has dropped markedly (Figure 2). Consumers in both emerging and developed economies have postponed larger expenditures, with those in emerging economies focusing more on essential products.

Tourism and travel sectors have suffered the strongest decline, with average spending per online shopper dropping by 75%.

Figure 2: Fall of average online spending per month since COVID-19, per product category

“During the pandemic, online consumption habits in Brazil have changed significantly, with a greater proportion of internet users buying essential products, such as food and beverages, cosmetics and medicines,” said Alexandre Barbosa, manager of the Regional Center of Studies on the Development of Information Society (Cetic.br) at the Brazilian Network Information Center (NIC.br).

Increases in online shopping during COVID-19 differ between countries, with the strongest rise noted in China and Turkey and the weakest in Switzerland and Germany, where more people were already engaging in e-commerce.

The survey found that women and people with tertiary education increased their online purchases more than others. People aged 25 to 44 reported a stronger increase compared with younger ones. In the case of Brazil, the increase was highest among the most vulnerable population and women.

Also, according to survey responses, small merchants in China were most equipped to sell their products online and those in South Africa were least prepared.

“Companies that put e-commerce at the heart of their business strategies are prepared for the post-COVID-19 era,” said Yomi Kastro, founder and CEO of Inveon. “There is an enormous opportunity for industries that are still more used to physical shopping, such as fast-moving consumer goods and pharmaceuticals.”

“In the post-COVID-19 world, the unparalleled growth of e-commerce will disrupt national and international retail frameworks,” said Carlo Terreni, President, NetComm Suisse eCommerce Association.

“This is why policymakers should adopt concrete measures to facilitate e-commerce adoption among small and medium enterprises, create specialized talent pools and attract international e-commerce investors.”

Digital giants grow stronger

According to the survey, the most used communication platforms are WhatsApp, Instagram and Facebook Messenger, all owned by Facebook.

However, Zoom and Microsoft Teams have benefitted the most from increases in the use of video calling applications in workplaces.

In China, the top communication platforms are WeChat, DingTalk and Tencent Conference, the survey shows.

Changes are here to stay

The survey results suggest that changes in online activities are likely to outlast the COVID-19 pandemic.

Most respondents, especially those in China and Turkey, said they’d continue shopping online and focusing on essential products in the future.

They’d also continue to travel more locally, suggesting a lasting impact on international tourism.