At the World Statistics Congress in Kuala Lumpur, UNCTAD held a session entitled “Multinational profit shifting and illicit financial flows – can we measure them?”.

“Financial flows related to profit shifting take an increasing share of global financial activity. These flows can no longer be ignored in economic statistics” said Mr. Fernando Cantu, Senior Statistician at UNCTAD who chaired the session.

Related link: Session on “Multinational profit shifting and illicit financial flows – can we measure them?”

This viewpoint was echoed by Ms. Mary Everett, Senior Adviser at the Irish Central Bank, who considered that “the increasing integration of the global economy implies a growing tension between economic activity and its measurement”. She continued by noting that national policy makers face serious difficulties when national statistics reflect the global rearrangements of multinational enterprises rather than the domestic reality of people living in the country.

“The major impacts of even minor organizational changes by large multinational enterprises on official statistics are alarming” said Mr. Peter van de Ven, Head of National Accounts at the OECD. The large impact of tax and profit optimization raises the question if GDP and many other key economic statistics are still valid as measures of domestic activity.

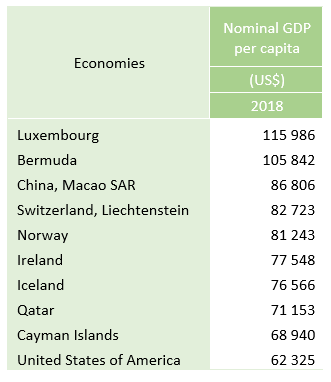

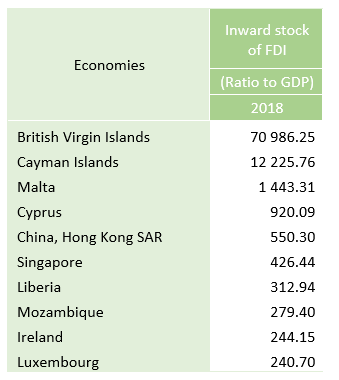

“What would financial flows look like if we could separate profits shifting from other financial flows?” asked Mr. Tjeerd Jellema, Adviser at the European Central Bank. The following tables which show the top-10 countries measured by GDP per capita and the stock of inward FDI illustrate the difficulty of knowing exactly how much key economic statistics actually reflect global arrangements of MNEs rather than domestic realities.

The debate underlined the urgent need for better and more detailed statistics on the global activities of multinationals. Unofficial estimates are showing huge profit shifting flows that may affect all key economic statistics, including GDP. The size of the impact depends on the country and its role in the global value chain, as well as the ability of the country to capture the activities of multinationals.

Whatever the country, statisticians will need to come together to arrive at better international consistency and develop additional statistics on the domestic economy. Work is well under way.

These efforts also contribute to the 2030 Agenda. To this end, a joint task force of UNCTAD and the United Nations Office on Drugs and Crime (UNODC) is working with experts from statistical offices, customs and tax authorities, jointly with Eurostat, IMF, OECD, UNECA and UN Statistics Division.

The task force met on 16-17 July 2019 in Geneva to discuss statistical definitions and methodologies to measure SDG indicator 16.4.1 on illicit financial flows (for more information: /external/meeting/task-force-meeting-statistical-methodologies-measuring-illicit-financial-flows). The proposal on the statistical methodology will be presented by end-2019 for consultation and then for approval by Chief Statisticians at the UN Statistical Commission.

gross domestic product per capita, 2018

the stock of inward FDI as a ratio to GDP, 2018

Source: UNCTADStat at https://unctadstat.unctad.org