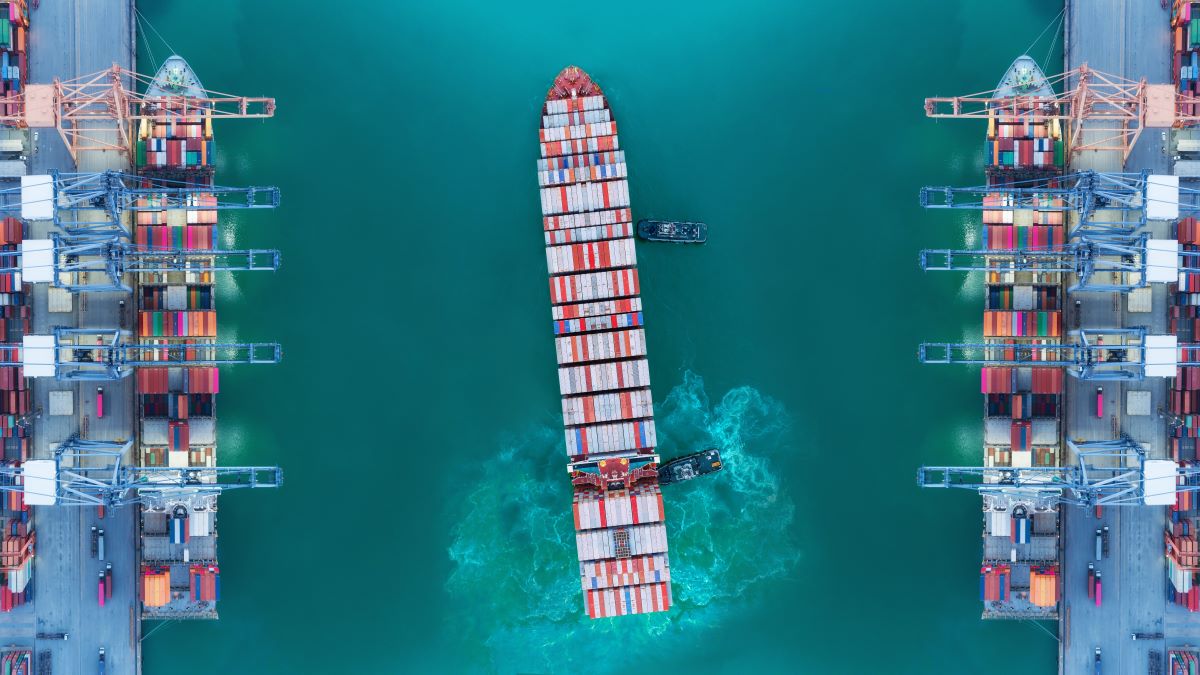

Maritime transport moves over 80% of goods traded worldwide. Country-level seaborne trade data is vital for shaping better transport, trade and investment policies.

© Shutterstock/Studio conept

UN Trade and Development (UNCTAD) released on 15 April new seaborne trade data. For the first time, the dataset includes country-level statistics.

Maritime transport is the backbone of global trade, moving over 80% of goods traded worldwide by volume. It connects global value chains, carrying raw materials and semi-processed goods to production hubs and delivering finished products to consumers. These flows are vital for industrialization, economic growth and job creation.

Seaborne trade has evolved over the decades, shaped by containerization, the rise of developing economies and shifting production and consumption patterns. Today, digitalization, geopolitics and the push for sustainability and climate resilience are redefining the sector.

A clearer picture of who ships what – and how much

Reliable, up-to-date country-level data is key to understanding trade flows and guiding better transport and trade policies and investment decisions.

Built from official trade data reported by governments to UN Comtrade, the new dataset offers a more accurate and comparable view of global maritime cargo movements, helping countries to:

- Monitor trade performance and competitiveness.

- Assess integration into global supply chains and trade networks.

- Inform port and transport infrastructure investment decisions.

- Track progress on Sustainable Development Goal 9.1.2 to develop quality, reliable, sustainable and resilient infrastructure – for which maritime freight and port cargo volumes are indicators.

Data highlights developing countries’ rising share of maritime trade

Historically, developing countries served mainly as loading hubs – major exporters of raw materials but marginal importers of manufactured goods. But this has evolved since the 1970s, driven by structural changes such as the oil crises, trade liberalization, increased private sector participation in port operations, the rise of container shipping and reforms to liner shipping alliances.

The shift accelerated in the early 2000s as developing countries increased trade among themselves – including in raw materials, oil and manufactured goods. Their share of global maritime freight rose from 38% in 2000 to 54% in 2023. The surge was led by Asia, with China driving much of the growth.

However, the share of least developed countries — mostly in Africa — and small island developing states remains small due to their small economies, limited infrastructure and weak integration into global value chains.

Maritime trade has shifted from liquid to dry cargo

Until the early 2000s, seaborne trade was dominated by liquid bulk, mainly oil. But with the rise of containerization and expansion of global value chains, it shifted toward dry cargo – including coal, iron ore, grain and manufactured goods.

Crude oil’s share fell from 29% in 2000 to 18% in 2023, while dry bulk commodities saw their share rise from 27% to 36%.

The shift also reflects China’s rise as both a global manufacturing hub and major importer of dry bulk commodities.

Major periods of shipping disruptions

Although maritime trade volumes have grown steadily, the data reveals periods of major disruption, including the 2008–2009 financial crisis and the COVID-19 pandemic.

More recently, the war in Ukraine, tensions in the Red Sea and a drought in the Panama Canal have further exposed vulnerabilities in key maritime corridors and checkpoints.

Turning data into action

UNCTAD’s seaborne trade dataset reinforces its wider maritime transport work – from the Review of Maritime Transport annual report to technical assistance and training.

This includes support for resilient maritime logistics, sustainable freight transport, sustainable and resilient logistics, port management, climate change adaptation in ports, trade facilitation, and customs automation and modernization (ASYCUDA).

Together, these tools help countries turn data into informed action – strengthening maritime trade systems, improving efficiency and making transport more sustainable and resilient. This ultimately keeps global trade flowing and supply chains operating.