Heightened reliance on exports of primary commodities has been a long-standing concern for policymakers in least developed countries (LDCs), because of the limited developmental benefits associated with this lopsided export specialization pattern, as well as the macroeconomic challenges it entails.

Source: UNCTAD secretariat calculations based on data from UNCTADstat database (consulted in January 2022)

Notes: Commodities classification follows Standard International Trade Classification (SITC) Revision 3. Three-year averages are considered to reduce the weight accorded to exceptional years.

Accordingly, the Istanbul Programme of Action (IPoA) envisaged the goal of broadening LDCs’ economic base to reduce commodity dependence.

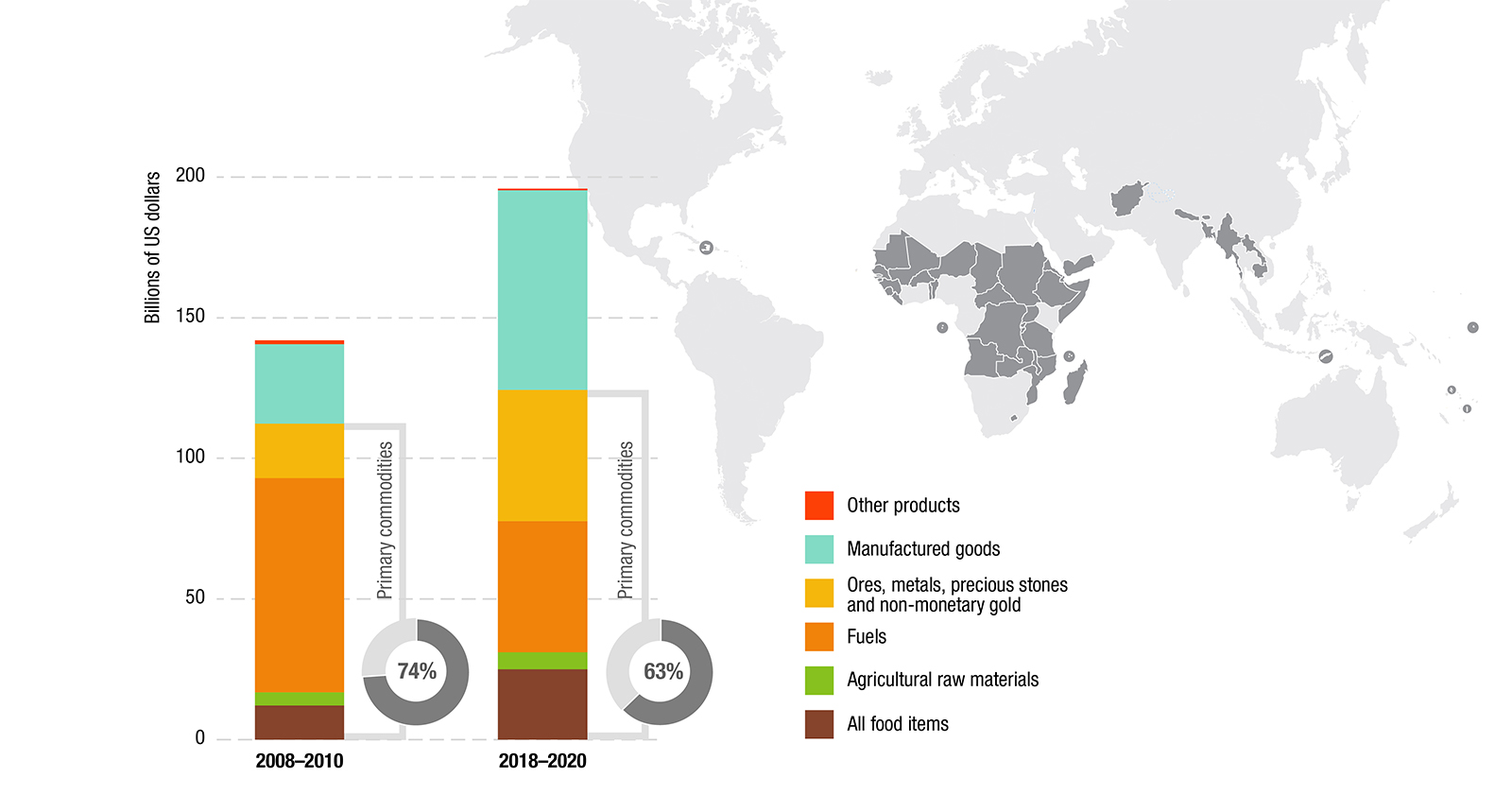

The above chart looks at the evolution of LDCs’ primary commodity dependence by contrasting the value of their merchandise exports, by broad product group, over the 2018-2020 period with the corresponding figures a decade earlier – before the adoption of IPoA.

Mixed picture

The comparison reveals a mixed picture. On the positive side, the data reveals an overall expansion of LDC export capacities, COVID-19 crisis notwithstanding, with a rapid increase of LDC manufactures exports, which grew by a factor of 2.5.

On the negative side, although the weight of primary commodities declined significantly, from 74% of total merchandise exports in 2008-2010 to 63% 10 years later, this remains above the commonly used threshold to identify commodity-dependent countries (60%).

Moreover, the persistent challenge of export diversification is epitomized by the fact that, in 2018-2020, LDCs accounted for 2.4% of global trade in primary commodities, but only 0.6% of global trade in manufactures.

Vulnerable to commodity price swings

However, the overall reduction in the weight of primary commodities is partly due to swings in international commodity prices, notably for fuels, which account for a significant share of LDCs’ export revenues.

Furthermore, the expansion of LDC manufactures exports is mainly accounted for by labour- or resource-intensive products. Moreover, the overall number of commodity-dependent LDCs has slightly increased over the period considered, from 34 to 37 (out of 46 LDCs!)

This was mainly the case among African LDCs, 90% of which (29 out of 32 countries) can be classified as commodity dependent, and Island LDCs 67% (four out of six countries). Moreover, even among Asian LDCs, which account for the bulk of LDC manufactures exports, commodity dependence still trapped 50% of them (four out of eight countries).

Policy priorities

Beyond underscoring the persistence of commodity dependence and LDCs’ lingering sustainable development challenges, the above picture highlights four policy priorities for the future.

- The drawbacks of LDCs’ reliance on a narrow range of primary products call for the adoption and implementation of a broad industrial policy framework geared towards developing domestic productive capacities, enhancing value addition, and fostering job creation in downstream industries.

- Stronger resource management, improved governance and tax administration, and tougher stance on illicit financial flows linked to trade misinvoicing (which disproportionately affects extractive industries) offer ample scope to improve value retention and rent mobilization in commodity sectors.

- Stronger regional integration – especially in the context of the Africa Continental Free Trade Area – could go a long way in supporting economic diversification and should thus be approached strategically to foster the emergence of thriving regional value chains.

- The volatility of commodity prices remains a serious threat to many LDCs, notably for sensitive products such as food and fuels. It is thus critical that ongoing efforts to foster a transition towards a low-carbon economy take place through concerted and fair multilateral action, avoiding disruptive impacts that may adversely affect vulnerable countries.

Downloads:

- The Least Developed Countries Report 2021: The least developed countries in the post-COVID world: Learning from 50 years of experience.

- The Least Developed Countries Report 2020: Productive capacities for the new decade

- Building and Utilizing Productive Capacities in Africa and the LDCs: A Holistic and Practical Guide

- Commodities and Development Report 2021: Escaping from the Commodity Dependence Trap through Technology and Innovation

- The State of Commodity Dependence 2021