COVID-19 has exacerbated the situation in least developed countries, with debt burdens now looming large on recovery efforts.

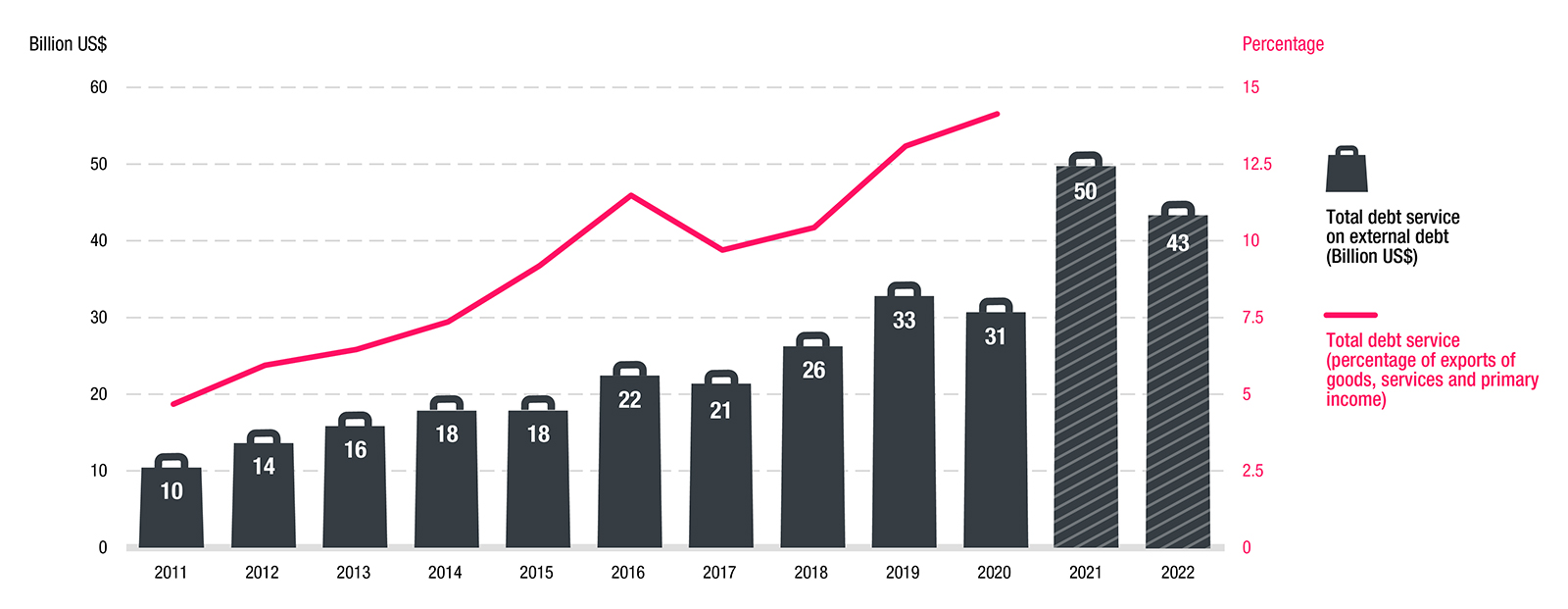

Note: the data reflects the current list of 46 Least Developed Countries; figures for 2021 and 2022 are preliminary.

Well before the COVID-19 outbreak, UNCTAD had repeatedly warned about the rapid debt build-up in developing countries, including the least developed countries (LDCs), highlighting associated risks for their debt sustainability outlook.

Partly due to the lack of alternative sources of development finance, for several years debt stocks continued to rise across LDCs. Moreover, the debt composition has gradually shifted towards more costly and riskier instruments such as short-term, private and commercial debt, all of which simultaneously raised debt service and potential costs of renegotiation.

Many LDCs entered the COVID-19 crisis with weaker fundamentals and greater indebtedness than they had 12 years before, at the onset of the global financial and economic crisis.

COVID-19 significantly exacerbated LDCs’ debt burden

The above chart shows the evolution of LDCs’ service on external debt, measured both in absolute terms - in billions of US dollars - and relative to exports of goods, services and primary income.

The chart shows how LDCs’ debt service tripled between 2011 and 2019, jumping from $10 billion to $33 billion; that is from roughly 5% to 13% of LDC exports.

More importantly, the graph also reveals the extent to which COVID-19 has exacerbated the situation, with debt burdens now looming large on LDCs’ recovery efforts and subtracting resources from urgent humanitarian and sustainable development spending.

LDCs’ total external debt service reached $31 billion in 2020, but for 2021 and 2022, this is expected to increase to $50 billion and $43 billion respectively. That is an increase of more than $20 billion compared to the pre-pandemic average.

Widespread and worsening vulnerabilities

In absolute terms, LDCs’ levels of indebtedness are dwarfed by their sustainable development needs. However, the generalized expansion of external debt raises serious concerns on debt sustainability, especially if the ongoing two-speed COVID-19 recovery will continue to bypass most LDCs.

In the median LDC, the ratio of external debt service to exports of goods, services and primary income has increased from 3% in 2011 to almost 10% in 2020; a value close to the threshold used in the Debt Sustainability Framework for weak performers.

In the same vein, at the end of 2021, four of the 45 LDCs covered by the Debt Sustainability Framework for Low Income Countries were categorized as being in debt distress and 16 at high risk of debt distress.

Policy priorities

In the wake of the COVID-19 crisis, worsening debt sustainability is a common concern for LDCs and other developing countries alike. The current trends expose long-standing asymmetries and systemic flaws of the prevailing international financial system.

Against this backdrop, the measures adopted by the G20, namely the Debt Service Suspension Initiative (DSSI), which expired at the end of 2021, and the G20 Common Framework for Debt Treatments beyond the DSSI, represented useful and timely initiatives, but they appear to be increasingly insufficient.

The present context warrants a systemic reform of the global financial architecture, addressing both the lack of adequate access to development finance and the challenges posed by precarious debt sustainability.

Key elements of such a reform agenda related to debt needs to include the establishment of an orderly, balanced and fair sovereign debt workout mechanism, as well as adequate debt relief for the most vulnerable and highly indebted countries, including LDCs.

Downloads:

- The Least Developed Countries Report 2019: The present and future of external development finance – old dependence, new challenges

- The Trade and Development Report 2019: Financing a global green new deal

- The Least Developed Countries Report 2020: Productive capacities for the new decade

- The Trade and Development Report 2020: From global pandemic to prosperity for all: avoiding another lost decade

- The Least Developed Countries Report 2021: The least developed countries in the post-COVID world: Learning from 50 years of experience

- Economic Development in Africa Report 2016: Debt Dynamics and Development Finance in Africa