Written by Zera Zheng, Article No. 128 [UNCTAD Transport and Trade Facilitation Newsletter N°104 - Fourth Quarter 2024]

Exploring strategies to bolster resilience in the shipping industry and for cargo owners, amidst compounding environmental, economic, and geopolitical challenges.

Rising global risks and polycrisis

The global landscape for supply chains has grown increasingly volatile, driven by the convergence of geopolitical instability, environmental challenges, and economic disruptions. These overlapping crises create a complex and uncertain environment often described as a ‘polycrisis,’ impacting transport reliability, shipping capacity, and demand for freight services.

Maersk’s recent survey[i] of over 2,000 European shippers reflects these challenges, with four out of five respondents identifying geopolitical tensions and inter-state conflicts as the most pressing risks to their supply chains. These risks are further exacerbated by environmental disruptions, economic instability, and additional geopolitical tensions, creating a feedback loop that amplifies disruptions across global supply chains.

A study published in Global Sustainability[ii] by Cambridge University highlights the interconnected nature of such risks, revealing how crises like climate change, pandemics, and geopolitical conflicts are causally linked, often intensifying one another’s effects. This interconnected risk landscape underscores the fragility of global supply chains to cascading disruptions, where a single crisis can trigger or amplify others.

In this volatile environment, businesses must prioritize developing comprehensive and multi-faceted resilience strategies to anticipate, manage, and mitigate the cascading impacts of these interconnected challenges.

Some implications for the shipping industry

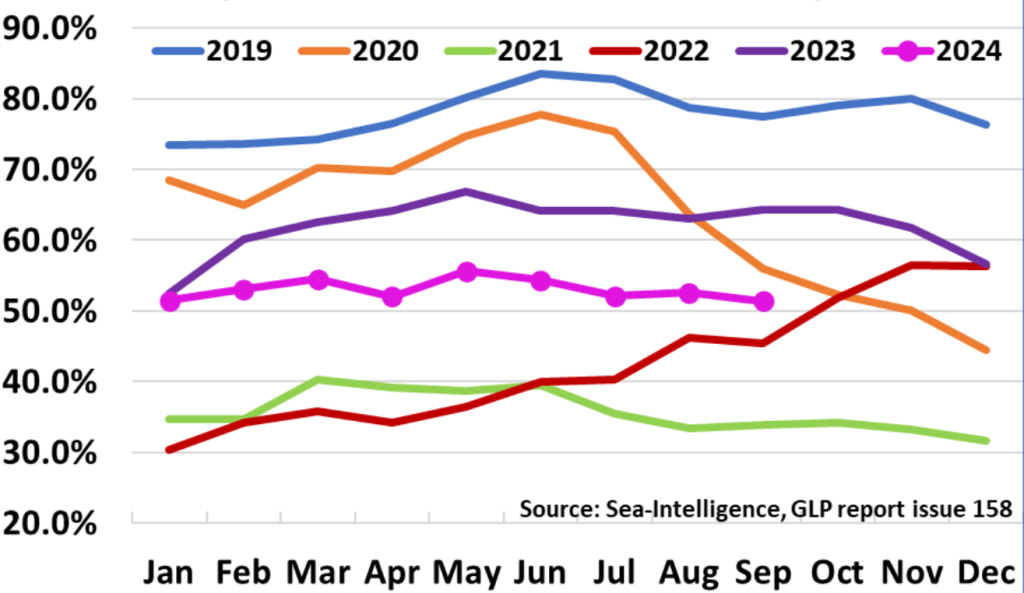

The complex interplay of these risks significantly impacts shipping. Schedule reliability, for example, has suffered due to persistent pressures across global shipping networks. According to Sea-Intelligence data[iii], global schedule reliability in 2024 has hovered between 50-55%, down from 70-85% pre-COVID, marking a stark contrast that reflects ongoing volatility (Figure 1).

Figure 1: Global schedules reliability

Source: Sea-Intelligence, 2024

Capacity constraints remain a critical issue. BIMCO's September 2024 report[iv] highlights the significant impact of geopolitical disruptions, such as rerouting around the Cape of Good Hope due to tensions in the Red Sea, which has absorbed an estimated 5-9% of global container vessel capacity. These disruptions have increased average sailing distances by 10% and driven ship demand to grow three times faster than cargo volumes in 2024. This divergence has exacerbated supply-demand imbalances, particularly in key trade lanes from the Far East to North Europe and the Mediterranean. Projections for 2025 suggest two possible scenarios: in the base scenario, where ships return to the Red Sea route, a 5-6% reduction in ship demand is expected; however, in an alternative scenario, where rerouting persists, ship demand may grow by 3.5-4.5%, further tightening the supply-demand balance.

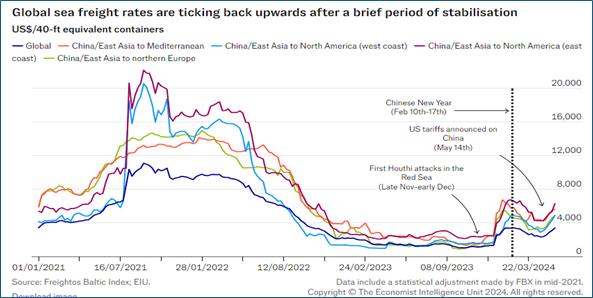

Freight rates have also been affected. Following relative stability in 2023, ocean freight rates surged again in 2024 (Figure 2), driven by geopolitical events and the added costs of vessel rerouting away from the Red Sea and new trade tariffs imposed by the United States on exports from China[v]. With the prospect of heightened trade tariffs, including potential increases between the U.S. and China, ocean freight rates are likely to remain volatile, complicating short-term demand projections for shipping markets.

Figure 2. Global sea freight rates are ticking back upwards after a brief period of stabilization

Source: The Economist Intelligence Unit, 2024

These dynamics underscore the need for adaptive strategies across the shipping industry. For shipping lines, terminals, logistics providers, and cargo owners alike, resilience is no longer optional—it is essential for navigating ongoing and future disruptions.

Building resilience in shipping networks

In shipping, resilience hinges on two fundamental aspects: managing shipping capacity and ensuring the reliability of ocean services. To maintain service levels, shipping lines need to adjust capacity to align with demand fluctuations while preserving schedule integrity to minimize cascading delays.

In case of port congestion, shipping lines face critical decisions about whether to wait for berthing, divert, or bypass specific ports. Delays at one port can impact entire schedules across linear networks. To address this, Maersk, in partnership with Hapag-Lloyd, is launching a hub-and-spoke network model in early 2025[vi]. The new Gemini Network design aims to enhance flexibility and reliability, targeting 90% ocean schedule reliability through adaptive scheduling and network design. This approach is designed to confine the impact of a disrupted port primarily to the regional feeder services connecting the hub to the affected port, minimizing disruptions to long-distance services. By containing disruptions locally, this model helps to mitigate cascading effects and maintain continuity in service levels.

Additionally, demand forecasting and risk analysis play crucial roles. Advanced technologies such as AI, machine learning, and predictive analytics enable shipping lines to anticipate demand patterns, adjust capacity, and preemptively reroute services in response to anticipated disruptions.

Enhancing port and terminal resilience

Port and terminal resilience is crucial to managing disruptions effectively. Key elements include, for example, a skilled workforce (e.g., dockworkers and vessel pilots), reliable information technology and operational technology systems that safeguard cybersecurity and operational efficiency, well-maintained equipment (such as gantries and cranes), and optimal space management for container storage and handling.

However, port resilience also depends on external network connections—highways, rail, and barging systems—that ensure seamless cargo flow. Without robust infrastructure, even the most efficient terminal operations can face significant bottlenecks. Recent examples underscore the importance of government support in bolstering port resilience. For instance, in response to severe congestion in the port of Singapore in May 2024, the Maritime and Port Authority reopened an old terminal facility to temporarily store containers and alleviate port traffic. This government-backed intervention significantly reduced vessel queuing times and helped stabilize the operational flow.

UNCTAD’s Port Resilience Guidebook[vii] offers a valuable framework for port authorities and terminal operators to build resilience by focusing on these internal and external components, helping ports around the world prepare for and manage future disruptions.

Shippers’ role in building their own resilience

For cargo owners, supply chain resilience has evolved —especially in the wake of COVID-19—from being merely a cost consideration to becoming a critical strategic priority. Today, resilience directly impacts profitability and investor confidence, making it essential to develop supply chains that are both adaptable and capable of withstanding future disruptions.

To enhance resilience, visibility and data integration have become indispensable tools, allowing cargo owners to monitor supply chains in real time and respond quickly to unforeseen disruptions. Access to real-time data enables faster decision-making, from rerouting shipments to adjusting inventory. Proactive risk monitoring is another critical measure, allowing logistics providers and their customers to anticipate disruptions and respond before issues escalate.

Shippers also need to focus on third-party risk management, which involves suppliers, logistics providers, and other key external partners critical to their operations. The resilience of their supply chains heavily depends on these partnerships across all tiers, making it vital to identify, assess, and mitigate risks throughout the extended network. For example, Taiwan’s worst drought in decades in 2021 severely affected the water-intensive semiconductor industry, leading to a global microchip shortage. This disruption cascaded across industries like automotive manufacturing, causing delays in new car deliveries in Europe and highlighting the importance of managing risks across interconnected supply chains.

At Maersk, we have developed a structured approach to resilience[viii], integrating supply chain risk assessment and alternative transport solutions. This methodology helps shippers analyze their dependencies and explore various logistics options that strengthen continuity, regardless of carriers or transport modes. By adopting these strategies, shippers can take a proactive approach to safeguarding their operations in the face of complex risks.

"In today's interconnected world, resilience is no longer just about managing risks—it's about anticipating them and adapting with agility," says Rico van Leuken, Global Head of Lead Logistics and Cold Chain Logistics at Maersk, "For manufacturers, the key lies in building supply chains that are not only flexible but also deeply informed by capturing and triangulating insights from a multitude of data sources. It enables faster identification of potential future risks, faster and smarter resolutions and ultimately it allows to turn supply chain risks into business opportunities. Doing this can no longer be seen as an optional activity, it is becoming integral to running supply chains. Companies that excel in this emerging supply chain discipline will gain a competitive lasting market advantage. Our advice is to invest in partnerships that extend visibility across all tiers of the supply chain and to integrate proactive risk monitoring, as these measures are essential for navigating the complex challenges of today and tomorrow."

Conclusion

The maritime industry faces an intricate web of risks spanning geopolitical, environmental, and economic domains. Building resilience across shipping lines, port operators, and cargo owners is imperative to navigating these challenges. Supply chain resilience is not only essential for the growth and continuity of individual companies but is also critical for regional and national economic stability. By fostering collaboration and sharing expertise, we can collectively develop a more resilient, adaptable global supply chain capable of withstanding future disruptions.

[i] Maersk, Discover New Paths to Supply Chain Resilience: How Are European Businesses Responding to Disruption?

[ii] Biermann, Frank, and Rakhyun E. Kim. “Global Polycrisis: The Causal Mechanisms of Crisis Entanglement.” Global Sustainability, vol. 3, 2020, pp. e18, https://doi.org/10.1017/sus.2020.13.

[iii] Sea-Intelligence Ocean Reliability

[vi] BIMCO Container Shipping Market Overview & Outlook

[v] Global trade update: freight rates are stabilising, EIU. 19 March 2024

[vi] Maersk: Network of the Future

[vii] UNCTAD Port Resilience Guidebook

[viii] Maersk Supply Chain Resilience Model

Contact the author:

Zera Zheng | Global Head of Business Resilience Consulting | A.P. Moller Maersk | [email protected] | https://www.linkedin.com/in/zera-zheng-5b5b68b/