COVID-19 causes steep drop in investment flows, hitting developing countries hardest. Recovery is not expected before 2022, says new UNCTAD report.

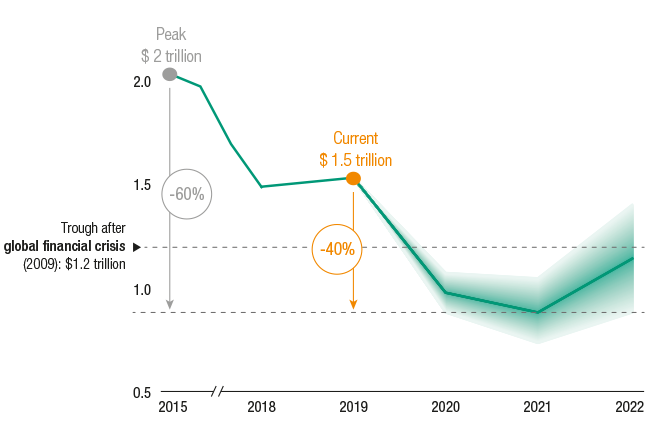

Global foreign direct investment (FDI) flows are forecast to decrease by up to 40% in 2020, from their 2019 value of $1.54 trillion, according to UNCTAD’s World Investment Report 2020.

This would bring FDI below $1 trillion for the first time since 2005. In addition, FDI is projected to decrease by a further 5% to 10% in 2021 and to initiate a recovery in 2022, the report says.

“The outlook is highly uncertain. Prospects depend on the duration of the health crisis and on the effectiveness of policies mitigating the pandemic’s economic effects,” said UNCTAD Secretary-General Mukhisa Kituyi.

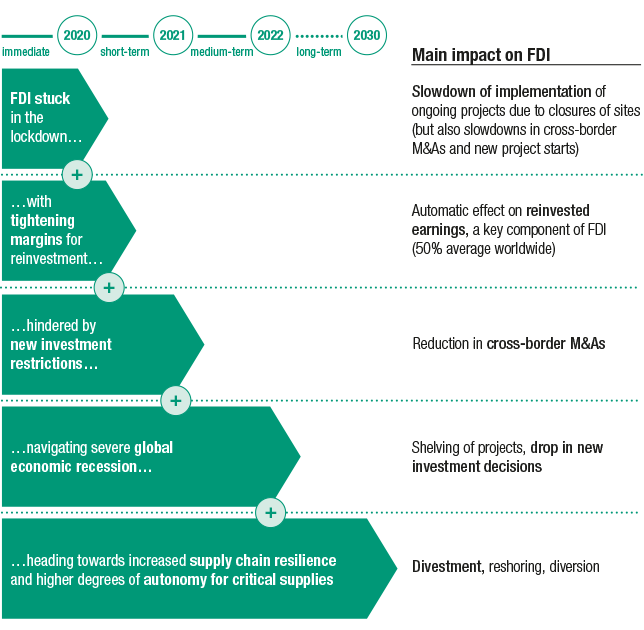

The pandemic is a supply, demand and policy shock for FDI. The lockdown measures are slowing down existing investment projects. The prospect of a deep recession will lead multinational enterprises (MNEs) to reassess new projects. Policy measures taken by governments during the crisis include new investment restrictions.

Investment flows are expected to slowly recover starting 2022, led by global value chains (GVCs) restructuring for resilience, replenishment of capital stock and recovery of the global economy.

Early warning sign

- Coronavirus (COVID-19) : News, analysis and resources

- World Investment Report 2020

- COVID-19 will likely transform global production, says UN report

- Investment flows in Africa set to drop 25% to 40% in 2020

- Investment flows to developing countries in Asia could fall up to 45% in 2020

- Foreign investment in Latin America expected to halve in 2020

MNE profit alerts are an early warning sign. The top 5,000 MNEs worldwide, which account for most of global FDI, have seen expected earnings for the year revised down by 40% on average, with some industries plunging into losses. Lower profits will hurt reinvested earnings, which on average account for more than 50% of FDI.

Early indicators confirm the immediacy of the impact. Both new greenfield investment project announcements and cross-border mergers and acquisitions (M&As) dropped by more than 50% in the first months of 2020 compared with last year.

In global project finance, an important source of investment in infrastructure projects, new deals fell by more than 40%.

“The impact, although severe everywhere, varies by region. Developing economies are expected to see the biggest fall in FDI because they rely more on investment in GVC-intensive and extractive industries, which have been severely hit, and because they are not able to put in place the same economic support measures as developed economies,” said James Zhan, UNCTAD’s director of investment and enterprise.

“Despite the drastic decline in global FDI flows during the crisis, the international production system will continue to play an important role in economic recovery and development. Global FDI flows will continue to add to the existing FDI stock, which stood at $37 trillion at the end of 2019,” Mr. Zhan added.

Global FDI flows rose modestly in 2019, following the sizable declines registered in 2017 and 2018. At $1.54 trillion, inflows were 3% up.

The rise in FDI was mainly the result of higher flows to developed economies, as the impact of the 2017 tax reforms in the United States waned.

Flows to transition economies also increased, while those to developing economies declined marginally. FDI flows to structurally weak, vulnerable and small economies remained stable overall, declining by only 1%.

Figure 1: Global FDI infows, 2015–2019 and 2020–2022 forecast

Figure 2: Impact of the pandemic on FDI: transmission mechanisms