Lockdown measures and factory stoppages in the wake of COVID-19 have severely impacted supply chain and factories’ production in the region.

Foreign direct investment (FDI) to developing economies in Asia, hit hard by the economic downturn caused by the coronavirus pandemic, are projected to decline by up to 45% in 2020, according UNCTAD’s World Investment Report 2020.

Bleak prospects for 2020

The number of announced greenfield investment in the first quarter of 2020 dropped by 37%. The number of mergers and acquisitions (M&As) fell by 35% in April 2020.

“Lockdown measures and factory stoppages impacted supply chain and factories’ production in the region. Falling corporate earnings, a slump in global and regional demand and economic slowdown have led multinational enterprises (MNEs) to postpone investment plans,” said UNCTAD’s director of investment and enterprise, James Zhan.

The pandemic will precipitate a fall in reinvested earnings of foreign affiliates based in the region, affecting investment. It underscored the vulnerability of these supply chains and the significance of the role of China and other Asian economies as global production hubs.

- Coronavirus (COVID-19) : News, analysis and resources

- World Investment Report 2020

- Global foreign direct investment projected to plunge 40% in 2020

- COVID-19 will likely transform global production, says UN report

- Investment flows in Africa set to drop 25% to 40% in 2020

- Foreign investment in Latin America expected to halve in 2020

Outward FDI is also expected to fall as a result of liquidity challenges faced by companies from the region.

A global economic recession will further weigh on inflows to and outflows from the region. Economic growth in Asia is expected to stall to 0%.

Moderate decline inflows in 2019

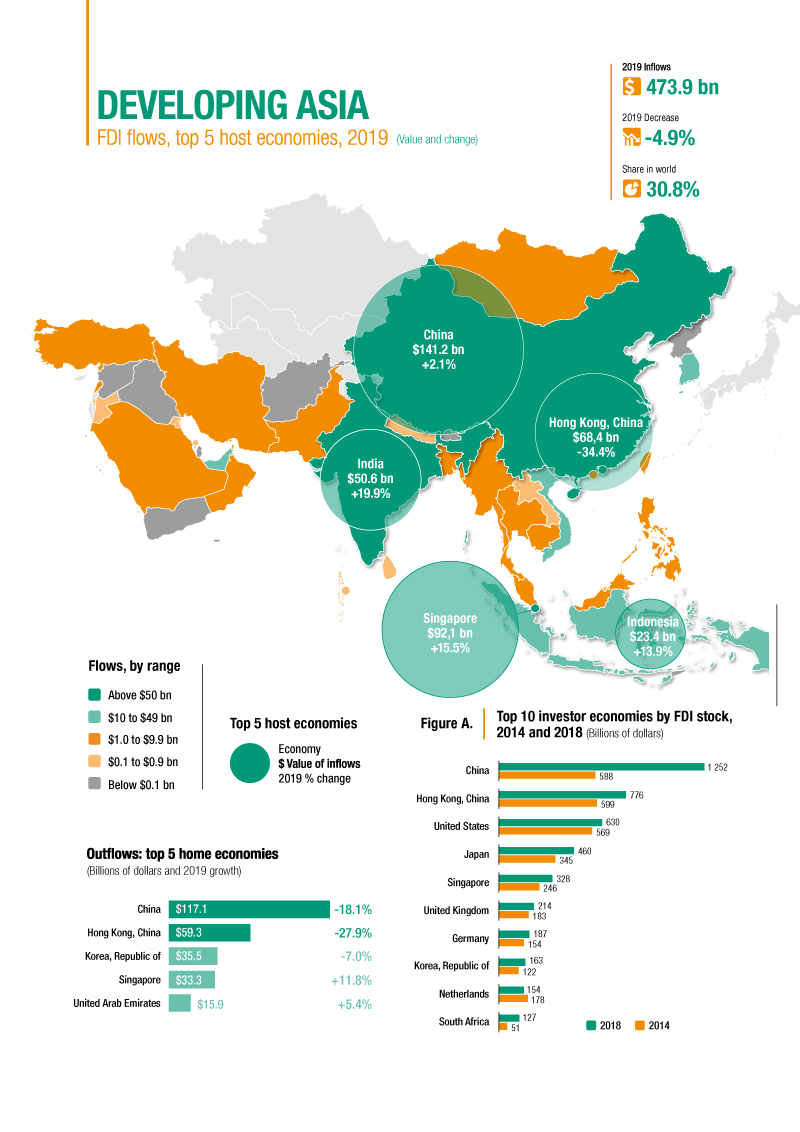

In 2019, FDI flows into developing economies in Asia declined by 5%, to $474 billion.

Growth in inflows in South Asia (10%) and South East Asia (5%) were not sufficient to offset the decline in investment in East Asia and West Asia (13% and 7% respectively).

Asia remained the world’s largest FDI recipient, hosting more than 30% of global inflows in 2019.

East Asia

FDI inflows to East Asia declined by 13% to $233 billion in 2019. Inflows to China rose to an all-time high of $141 billion despite trade tensions.

Investment flows to Hong Kong, China declined by 34% to $68 billion in 2019, recording a fourth consecutive annual decrease.

Flows to the Republic of Korea dropped by 13%, to $11 billion, attributed to trade tensions with Japan and the end of tax breaks for foreign investors in 2018.

South-East Asia

South-East Asia, with FDI rising by 5% to a record level of $156 billion, continued to be the region’s growth engine in 2019. The growth was driven by strong investment mainly in Singapore, Indonesia and Viet Nam. The three countries received more than 80% of inflows in South-East Asia in 2019.

Robust investment from Asian economies, United States and within the Association of Southeast Asian Nations (ASEAN) pushed up inflows. Manufacturing and services continued to underpin inflows to South-East Asia.

FDI flows to some ASEAN member States (e.g., Myanmar, the Lao People’s Democratic Republic and Thailand) fell. Investment to Malaysia was flat.

South Asia

FDI flows to South Asia increased by 10% to $57 billion. The rise was driven largely by a 20% increase in investment in India, the largest South Asian FDI recipient, to $51 billion.

Most of the investments in India went to the information and communication technology (ICT) and the construction industries.

Flows to Bangladesh fell by 56% to about $2 billion, reflecting an adjustment from a record-high level in 2018. In Pakistan, FDI recovered, growing 28% to $2 billion after a 30% fall in 2018.

West Asia

FDI to West Asia declined by 7% to $28 billion. Three countries - Turkey, the United Arab Emirates and Saudi Arabia - accounted for the majority of inflows in 2019.

The United Arab Emirates was the largest FDI recipient in West Asia, with flows of almost $14 billion in 2019, growing by a third from the preceding year.

Flows to Saudi Arabia increased for the second consecutive year by a further 7% to $4.6 billion because of a few large M&A deals.

FDI flows to Turkey declined by 35% to $8.4 billion and investment to other countries in West Asia was flat or declined.

Continued decrease in outflows

Outflows from Asia declined by 19% to $328 billion, a further decline from 2018. The decline in commodity prices, geopolitical tensions and China’s restrictions on outward FDI contributed to the fall.

Outflows from East Asia recorded a third consecutive annual decrease, by 21% to $224 billion. Investment from South-East Asia and West Asia declined by 11% to $56 billion and 30% to $36 billion in 2019, respectively. Outflows from South Asia grew 6%, driven by investment from India.

Outward investment from other major economies such as Hong Kong (China), the Republic of Korea, Saudi Arabia and Thailand declined. Singapore and India, however, are among the few economies that reported an increase in outward investment.