All industries on the continent are reeling from the double blow of the coronavirus pandemic and low commodity prices, UNCTAD’s new report says.

The trend of declining foreign direct investment (FDI) to Africa is set to exacerbate significantly in 2020 amid the dual shock of the coronavirus pandemic and low prices of commodities, especially oil.

FDI flows to the continent are forecast to contract between 25% and 40% based on gross domestic product (GDP) growth projections as well as a range of investment specific factors, according to UNCTAD’s World Investment Report 2020.

“Although all industries are set to be affected, several services industries including aviation, hospitality, tourism and leisure are hit hard, a trend likely to persist for some time in the future,” said UNCTAD’s director of investment and enterprise, James Zhan.

Manufacturing industries intensive in global value chains are also strongly affected, a sign of concern for efforts to promote economic diversification and industrialization in Africa.

Overall, there is a strong downward trend in the first quarter of 2020 for announced greenfield investment projects, although the value of projects (-58%) has dropped more severely than their number (-23%).

Similarly, as of April 2020, the number of cross-border merger and acquisition (M&A) projects targeting Africa had declined 72% from the monthly average of 2019.

- Coronavirus (COVID-19) : News, analysis and resources

- World Investment Report 2020

- Global foreign direct investment projected to plunge 40% in 2020

- COVID-19 will likely transform global production, says UN report

- Investment flows to developing countries in Asia could fall up to 45% in 2020

- Foreign investment in Latin America expected to halve in 2020

Hope for recovery

However, two distinct factors offer hope for the recovery of investment flows to the continent in the medium to long run. The first is the higher value being assigned to ties to the continent by major global economies, promoting investment in infrastructure, resources, but also industrial development.

Investments from these countries, which have varying degrees of political backing, despite being affected by the joint impact of COVID-19 and low commodity prices to some degree, could be relatively more resilient.

The second is deepening regional integration due to the commencement of trade under the African Continental Free Trade Area (AfCFTA) after years of deliberation and the expected finalization of its investment protocol.

In the short term, curtailing the extent of the investment downturn and limiting the economic and human costs of the pandemic is of paramount importance.

Longer term, diversifying investment flows to Africa and harnessing them for structural transformation remains a key objective. Both of these objectives will require a prudent, coordinated and timely response from countries on the continent.

FDI was already on the decline before the crisis

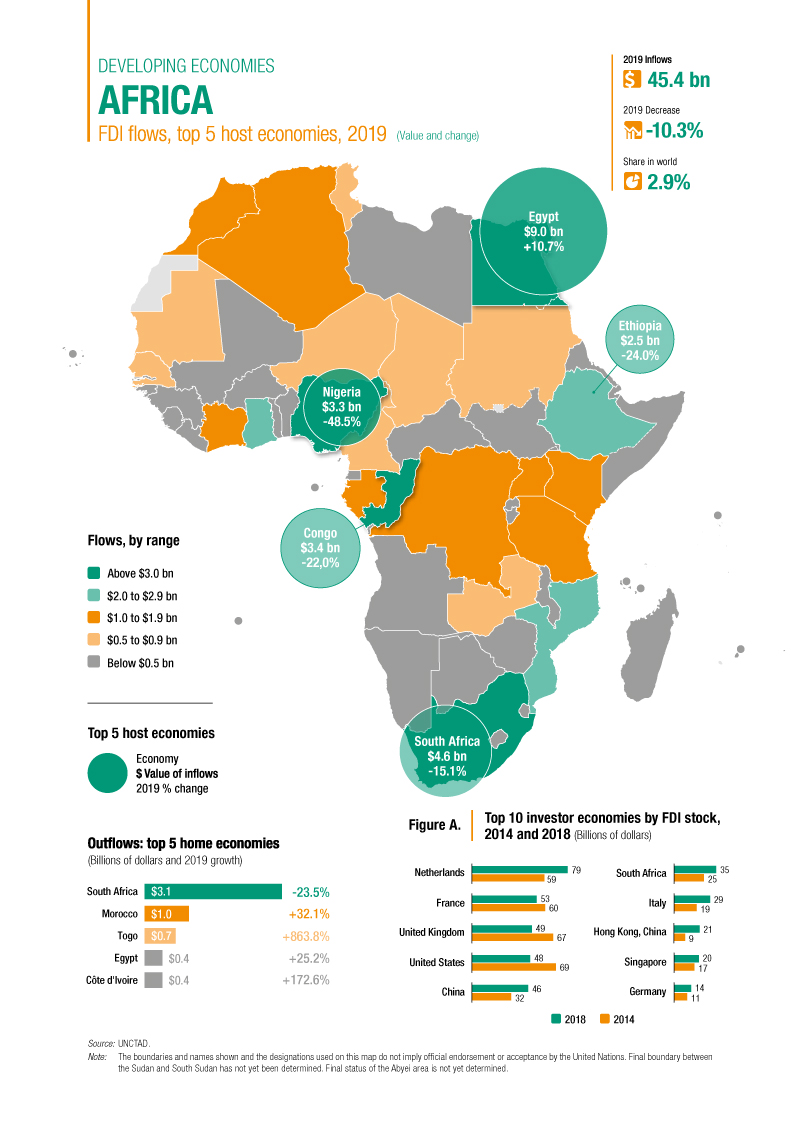

The COVID-19 crisis has arrived at a time when FDI was already in decline, with the continent having experienced a 10% drop in inflows in 2019 to $45 billion.

The negative effects of tepid global and regional GDP growth and dampened demand for commodities inhibited flows to countries with both diversified and natural resource-oriented investment profiles alike, although a few countries received higher inflows from large new projects.

North Africa

FDI inflows to North Africa decreased by 11% to $14 billion, with reduced inflows in all countries except Egypt, which remained the largest FDI recipient in Africa in 2019, with inflows increasing by 11% to $9 billion.

Sub-Saharan and Southern Africa

After a significant increase in 2018, FDI flows to Sub-Saharan Africa decreased by 10% in 2019 to $32 billion.

Southern Africa was the only sub-region to have received higher inflows in 2019 (22% increase to $4.4 billion) but only due to the slowdown in net divestment from Angola.

FDI inflows to South Africa decreased by 15% to $4.6 billion in 2019, despite key investments in mining, manufacturing (automobiles, consumer goods) and services (finance and banking).

West Africa

FDI to West Africa decreased by 21% to $11 billion in 2019. This was largely driven by the steep decline in investment in Nigeria due to new investment regulations for multinational enterprises in the oil and gas industry.

East Africa

FDI flows to East Africa also decreased, by 9% to $7.8 billion. Inflows to Ethiopia contracted by a fourth to $2.5 billion caused to some degree by political tensions in parts of the country.

Similarly, inflows to Kenya dropped by 18% to $1.3 billion despite several new projects in IT and healthcare.

Central Africa

Central Africa received $8.7 billion in FDI, marking a decline of 7%. The key highlight in the sub-region was the decrease in flows to the Democratic Republic of the Congo (9% to $1.5 billion).

The Netherlands overtook France as the largest investor by stock

On the basis of FDI stock data through 2018, the Netherlands overtook France as the largest foreign investor in Africa.

The investment stock held by the United States and France in Africa declined by 15% and 5% respectively, owing to profit repatriation and divestment. Meanwhile, the investment stock of the United Kingdom and China increased by 10% each.

FDI outflows also fell in 2019, by approximately a third

FDI outflows from Africa decreased by 35% to $5.3 billion. South Africa continued to be the largest outward investor despite the reduction in outflows from $4.1 billion to $3.1 billion.

Outflows from Togo increased significantly, from a mere $70 million to $700 million, a tenfold increase. In North Africa, Morocco also increased outward FDI, to approximately $1 billion from $800 million in 2019.